IS Solomon Islands a tax haven – a country where rich people invest and corporate entities invest their money to avoid paying tax in their own country.

As well, tax haven countries have secrecy laws, that block information on their deposits from foreign tax authorities.

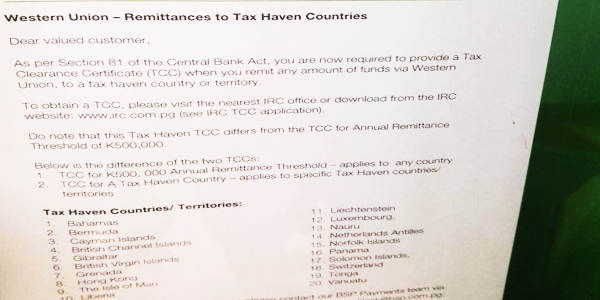

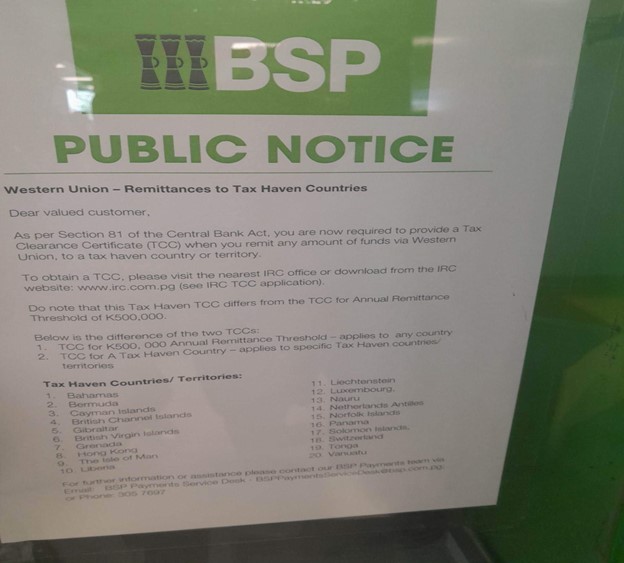

According to a public notice put out by Bank South Pacific [BSP] for its Western Union customers, Solomon Islands is a Tax Haven.

This has taken many Solomon Islands nationals by surprise, saying Solomon Islands could never have been a tax haven because it has some of the toughest tax legislations in the Pacific region.

In general, a tax haven is a country that offers foreign businesses and individuals minimal or no tax liability for their bank deposits in a politically and economically stable environment.

“They have tax advantages for corporations and for the very wealthy, and obvious potential for misuse in illegal tax avoidance schemes.

“Companies and wealthy individuals may use tax havens legally as a means of stashing money earned abroad while avoiding higher taxes in the U.S. and other nations.

“Tax havens may also be used illegally to hide money from tax authorities at home. The tax haven can make this work by being uncooperative with foreign tax authorities. In recent times, tax havens are under increasing international political pressure to cooperate with foreign tax fraud inquiries.”

In brief, Tax havens:

- Encourage foreign depositors by offering tax advantages to corporations and the wealthy;

- Many have secrecy laws that block information on their deposits from foreign tax authorities; and

- Depositing money in a tax haven is legal as long as the depositor pays the taxes required by the home jurisdiction.

Solomon Star was unable to get a comment from BSP or Western Union on the public notice, published by the Port Moresby Office of BSP.

By Alfred Sasako