Top gov’t officials block foreign investment dollar inflow from Chinese investment into the country despite gov’t opening doors to Chinese investors

TOP public servants holding key positions in strategic investment portfolios have been accused of blocking hundreds of millions of dollars in new investments, warning that unless the government intervenes, the situation would only get worse.

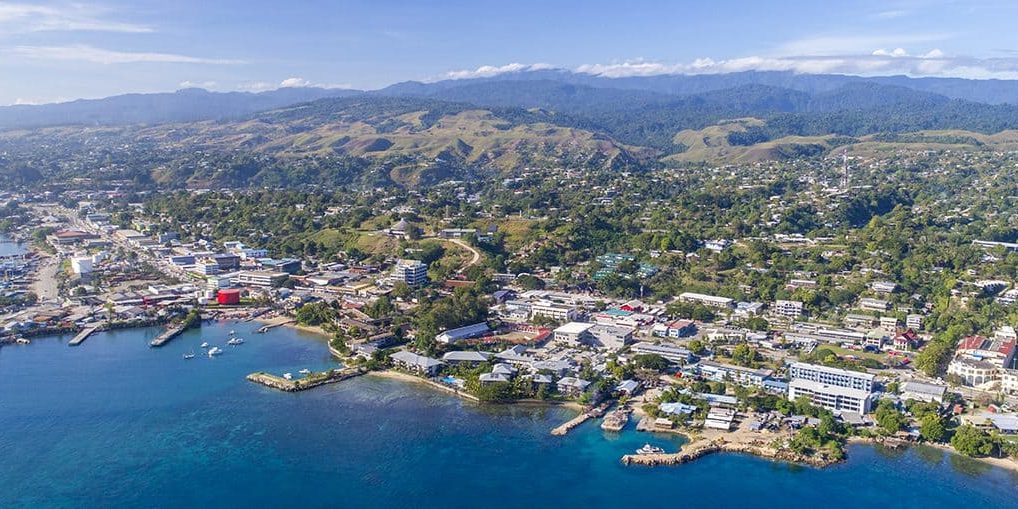

Former Prime Minister Manasseh Sogavare signed an accord with the Government of the People’s Republic of China in 2023, followed by the Minister of Commerce, Industry, Labor and Immigration, Fredrick Kolegeto, who travelled to China in the same year and signed a trade agreement with the PRC Government.

From these foreign policy agreements, the door was opened to the Chinese Investors, the sources said. Experiences have shown it was not to be.

They accused the Director of Foreign Investment of contravening the SIG Government Foreign Policy. The Director has made her own rules and her own ideas and turned them into an unwritten regulation, they claimed.

They also accused the Director of Foreign investment of being “racist, bias and totally anti-Chinese when talking about the mining sector.

“The Foreign Investment Act is meant to facilitate investment not to prejudge and at random terminate the efforts of the investor. The Act if applied means the register based on the criteria of the Act and its regulations approves the company to be able to open a bank account and deposit the money for the project in the Solomon Islands.

“From this point the investor can then commence to apply for the license approved by the Foreign Investment Director. For sake of argument you’re applying for a prospecting license to explore for minerals, although you qualify the foreign investment criteria to apply for this license the Director of Foreign Investment will terminate your application at the Mines Board level,” they said.

The Director of Mines follows these made-up regulations and is a part of the problem, how does it work, if you make through Foreign Investment, you submit a Prospecting License application if you are fortunate your application cost is ten thousand dollars which is not refunded should you fail the vetting process of the Mines and Minerals Board.

“Once the ‘Prospecting License application is lodge into the Ministry of Mines Portal where it is vetted by four (4) persons including the Director of Mines. Now at this stage, you have made it through Foreign Investment and now the Director of Mines has approved the application to be heard by the Mines and Minerals Board.”

And that is where the hopes of the investor are terminated, to give the public a look into the amount of Money being offered among 12 prospecting license application the total would average minimum of $120 – $180 million Solomon dollars

To salvage the situation, the sources familiar with the matter, are demanding drastic changes.

They are calling for the immediate removal of the Director of the Foreign Investment Division of the Ministry of Commerce, Industry, Labor and Immigration.

The sources have singled out the Mines and Minerals Board and the Foreign Investment Board as the alleged culprits for driving foreign investors away.

“Their actions have turned investors away, particularly in the mining industry, where foreign investors have lined up to inject much-needed cash into Solomon Islands’ struggling economy only to find they could not even get past the foreign investment or the Mines and Minerals Board meetings,” the sources who spoke on condition of anonymity, told Solomon Star in an exclusive interview on the weekend.

They said government ministers are fully aware of what is going on, but few have made a move to correct the situation.

The investor pointed, for example, to a proposal to build a cement factory on Guadalcanal, but it was allegedly knocked back by the Foreign Investment Director.

“That investment is valued at $270 million – the sort of investment we need for creating jobs for our young people. But after a detailed submission was made to the FIB, the project was knocked back for some strange reason,” they said.

But that’s not all, according to the sources.

The Mines and Minerals Board also had a fair share of the blame for allegedly knocking back foreign investors in the mining industry right, left and center.

“For example, nine applications went before the Mines and Minerals Board in the last quarter of last year. They were all rejected,” the sources said.

“Investors, particularly from China are getting frustrated because they could not get anywhere with their applications for a Letter of Intent (LOI) after paying $10, 000 application fee each to put their application through.

“In many cases, submitting an application is as far as these investors get. Alleged demands by senior Board members for something that is not even in the Minerals Act have put obtaining an LOI beyond the reach of many investors,” they said.

Chinese investors in particular are lost because there is no published guide written in Chinese to help them understand the legal requirements to follow, they said.

One company for example, had access to $27 million to offload in the mining industry here. That company also has an additional $1 million in the country as a deposit, but its application was still rejected,” the sources said.

The sources also revealed another company, which has a deposit of $1 million in an account in the country. Its application was allegedly rejected, because it did not have an office in Honiara, explaining we only arrived, and we will invest and open an office when our investment is approved, they said.

They are calling on the government to replace both the Director of Mines as well as the Director of the Foreign Investment Division with an experienced qualified expatriate from.

“It is the only way to get things moving in the right direction here,” they said.

Chinese investors are losing millions of dollars here to pay people to help prepare their applications. Despite this, they are not getting anywhere, the sources said.

They are suggesting publishing an article with the screaming headline, “Chinese investors are not welcome in Solomon Islands.”

“Do you wonder why the government has no money to pay for social services such as education and health, among other things,” they asked.

The Government needs to step in and correct the abnormality in the system as soon as possible, they said.

Solomon Star will get to the Director of the Foreign Investment Board for her response.

By Alfred Sasako